cook county parking tax portal

If your business is subject to any of the following taxes you must use the portal. The City of Buffalo will charge a 225 convenience fee on Credit Card or Debit Card payments made through this web site with a minimum fee of 200.

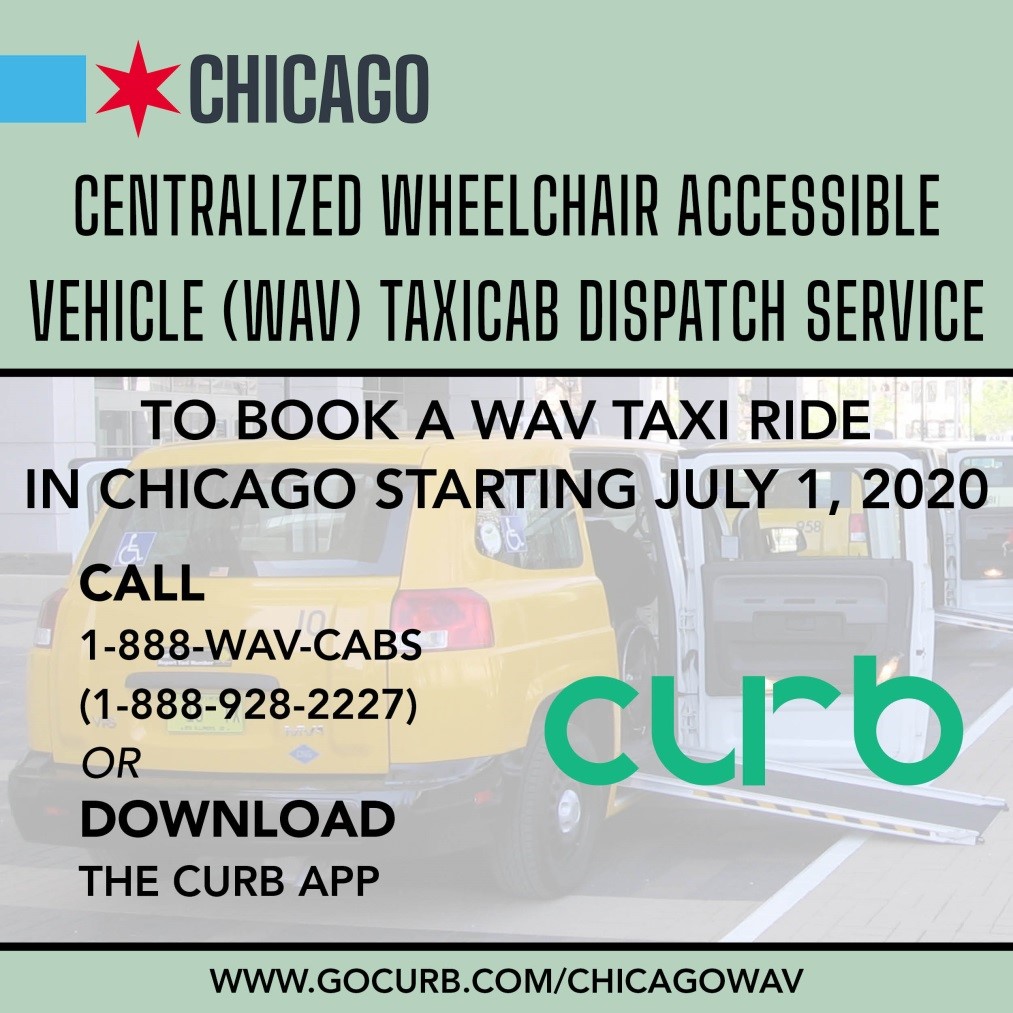

City Of Chicago Chicago Wheelchair Accessible Taxicabs Wav

Erie County Executives Office 95 Franklin Street 16th Floor Buffalo New York 14202.

. Their efforts have primarily focused on the enforcement of. Effective september 1 2013 the cook county board of commissioners approved a change to the structure of the parking tax imposed upon the use and privilege of parking a motor vehicle in. The Cook County Property Tax Portal The Cook County Property Tax Portal created and maintained by the Cook County Treasurers Office consolidates information from the elected officials who take part in the property tax system and delivers Cook County taxpayers a one-stop customer service website.

Pay At Your Local Community Bank. Pay At Chase Bank. 1001COUNTYWIDE Transportation and Storage and Mail Services Download List.

The Senior Citizen Real Estate Tax Deferral Program. Wed 07172013 - 1200. The fee is pursuant to the provisions of Section 3-19 of the city charter.

Countywide Parking Spaces for Reserved and Self Park County Owned Vehicles. Erie County Executives Office 95 Franklin Street 16th Floor Buffalo New York 14202. Parking lot and garage operations.

Payments Check Your Payment Status or Make an Online Payment. This unique 14-digit sequence number is assigned to the legal description for each piece of real estate in Cook County including vacant lots parking spaces and condominium common areas. The tax shall be collected from any person who seeks the privilege of occupying space in or upon any parking lot or garage.

The Cook County Parking Lot and Garage Operations Tax Section 74-510 74-549 allows for a tax imposed upon the use and privilege of parking a motor vehicle in or upon any parking lot or garage in the County. Cook county use tax portal. The Portal consolidates information and delivers Cook County taxpayers a one-stop customer service website.

Calculate the cost of a building permit. If an entity owns and operates more than one location subject to Cook County Hotel Accommodations Tax please submit the additional site list along with the registration. Pay By Mail or In Person.

1 amusement tax 2 alcoholic beverage tax 3 gasoline and diesel fuel tax 4 hotel accommodations tax and 5 parking lot and garage operations tax. Our vault holds official copies of all real estate documents recorded since the organization of Cook County in 1871. Cook county parking tax portal.

Maria Pappas Cook County Treasurers Resume. All other Cook County home rule taxes will continue to be administered outside the portal. You must create an online portal profile before being able to file tax returns remit tax due submit service requests etc.

Cook County Property Tax Portal. Pure Life Chiropractic Scottsdale. The Cook County Board today approved an amendment that would lower the tax rate for many individuals who park in garages and lots.

In the past 3-5 years we have seen a significant uptick in the Departments audit activity and challenges to Taxpayer positions. Effective september 1 2013 the cook county board of commissioners approved a change to the structure of the parking tax. 03082022 1000 AM 04062022 1000 AM 2211-02089.

Property Tax Relief for Military Personnel. The City of Buffalo will charge a 200 convenience fee if paying by checkACH from your bank account. Commissioners approved a 6 percent tax rate for daily parking and a 9 percent rate for weekly and monthly parking.

Get a Copy of Your Tax Bill. The PIN is used for assessments tax rate calculations and tax collections. Freedom of Information Act FOIA Request.

The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. 22 for daily parking during the week as well as all weekly and monthly parking. Cook County Use Tax Portal.

Hotel Accommodations Tax Return Please use the registration form to register for the Cook County Hotel Accommodations Tax this form can also be used to register for other Cook County home rules taxes. The Cook County Property Tax Portal The Cook County Property Tax Portal created and maintained by the Cook County Treasurers Office consolidates information from the elected officials who take part in the property tax system and delivers Cook County taxpayers a one-stop customer service website. NEW 1182021 - Firearm and Firearm Ammunition Tax must be collected beginning November 15 2021 On November 4 2021 the Cook County Board of Commissioners amended the Firearm and Firearm Ammunition Tax Ordinance to address the uniformity concerns expressed by the Illinois Supreme Court in the Guns Save Life ruling.

The Cook County Treasurers Office website was designed to meet the Illinois Information Technology Accessibility Act and the Americans with. The Parking Lot Tax has recently been targeted by the Cook County Department of Revenue. Freedom of Information Requests.

Duties and Responsibilities of the Cook County Treasurer. Cook county property tax portal. This change is the result in a state law passed this year that allows Cook.

The cook county treasurers office provides payment status for current tax years and the ability to pay online. New Life Christian Academy Fayetteville Nc. Seasonal Road Weight Limits Highway.

The cook county assessor sets the taxable value on all of the more than 18 million parcels of real estate located in cook county. You use the tax form function to update federal and state tax details such as filing status allowances and exemptions. Maria Pappas Cook County Treasurers Biography.

The Department of Revenue collects and processes approximately 46000000000 per year and continues in its efforts to increase tax compliance and collections along with providing efficient service to our customers through well-informed and skilled personnel. The Department of Revenue was established by the Cook County Board of. All of the Real Estate documents are open to the public for review or copies.

The Recorders Office is responsible for maintaining a permanent repository of recorded documents for real property. Italian Restaurant Santa Barbara Blvd Naples Fl. The cook county property tax system is complex.

Busse Road Improvement Study By Cook County Village Of Mount Prospect Il

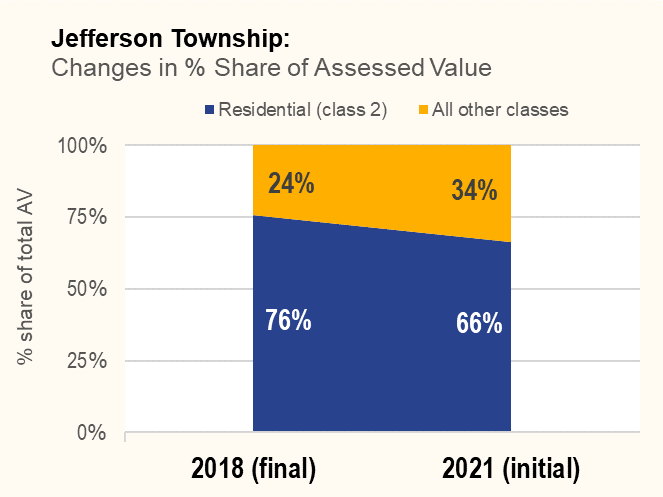

Rogers Park 2021 Valuation Reports Cook County Assessor S Office

Your Property Tax Bill Village Of Brookfield

Jefferson Township Valuation Reports 2021 Cook County Assessor S Office

Busse Road Improvement Study By Cook County Village Of Mount Prospect Il

The Cook County Property Tax System Cook County Assessor S Office

Cook County Property Tax Bill And Property Exemptions Village Of Crestwood

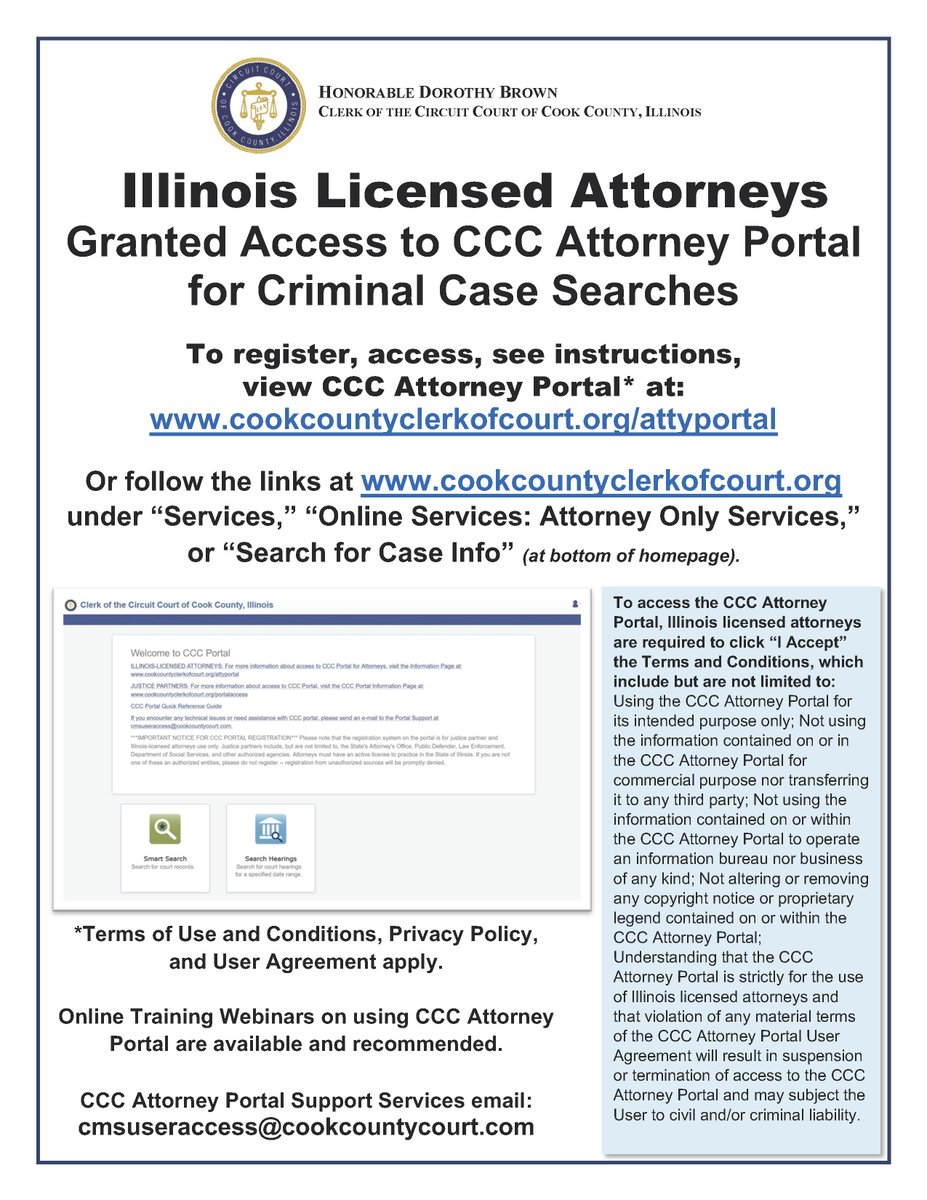

Dorothy Brown Courtclerkbrown Twitter

Current Purchasing And Contract Opportunities

The Cook County Property Tax System Cook County Assessor S Office